BlackBerry pleads for patience after brutal quarter.

One analyst describes BlackBerry’s results as a “complete disaster” as the company disappointed on virtually every single financial metric.

BlackBerry’s “solid ground” just got shakier.

The company on Friday posted a loss in its fiscal first quarter, whereas analysts had projected at profit. Compounding the negativity was the eventual disclosure that it only sold 2.7 million BlackBerry 10 devices in the quarter and saw its subscriber base fall by 4 million to 72 million.

It was a bad day for BlackBerry all around. The surprising and disappointing numbers underscore the continued challenges the company faces as it continues its slow efforts for a recovery. But with losses expected to continue piling up, some are wondering if a comeback is even possible. With a market dominated by Apple and Samsung, BlackBerry may be badly outgunned.

What’s worse is that the situation doesn’t look like it will be improving for a while. BlackBerry warned it will post another loss in the current quarter and said it will continue to invest in products and services over the next three quarters, suggesting that the company will remain in the red for another year. Throughout it all, BlackBerry CEO Thorsten Heins asked for more time and a longer-term view from analysts and industry observers who seemed short on patience.

“It is a complete disaster,” Pierre Ferragu, an analyst at Sanford Bernstein, said in an e-mail to CNET.

Wall Street agreed with his assessment. BlackBerry lost more than a quarter of its market value, falling 25.5 percent to $10.69 in early trading this morning.

The sentiment is far different from just a month ago, when Heins declared during its annual developer conference that the company had gotten back some of its groove.

“It hasn’t been that easy, and there’s still a lot of work to do, but man, have we reached solid ground with this company,” Heins said during his keynote address at BlackBerry Live in May. At the time, he was met with thunderous applause from the BlackBerry faithful.

Today, Heins endured a string of painful questions ranging from his thoughts on the disappointing BlackBerry 10 sales to how much time the board had given him before he had to ditch his current plans.

In his response, Heins sought patience from the investment community, saying that the company wasn’t done launching products and noted that they each required significant marketing investment to stand out in a competitive market. He said fiscal 2014 (its current fiscal year) marks a period of investment, which will set the company up for growth next year.

BlackBerry CEO Heins at the company’s developer conference in May.

BlackBerry CEO Heins at the company’s developer conference in May.“It’s a new experience, so this takes a bit of time, it takes some investment,” he said.

Heins, however, demurred on many of the more pointed questions, such as his thoughts on what many regard as disappointing unit sales.

“We’re in the middle of it, so it’s really too early to say,” he said. “You’ve got to be on your tippy toe all the time, and that’s what we’re doing.”

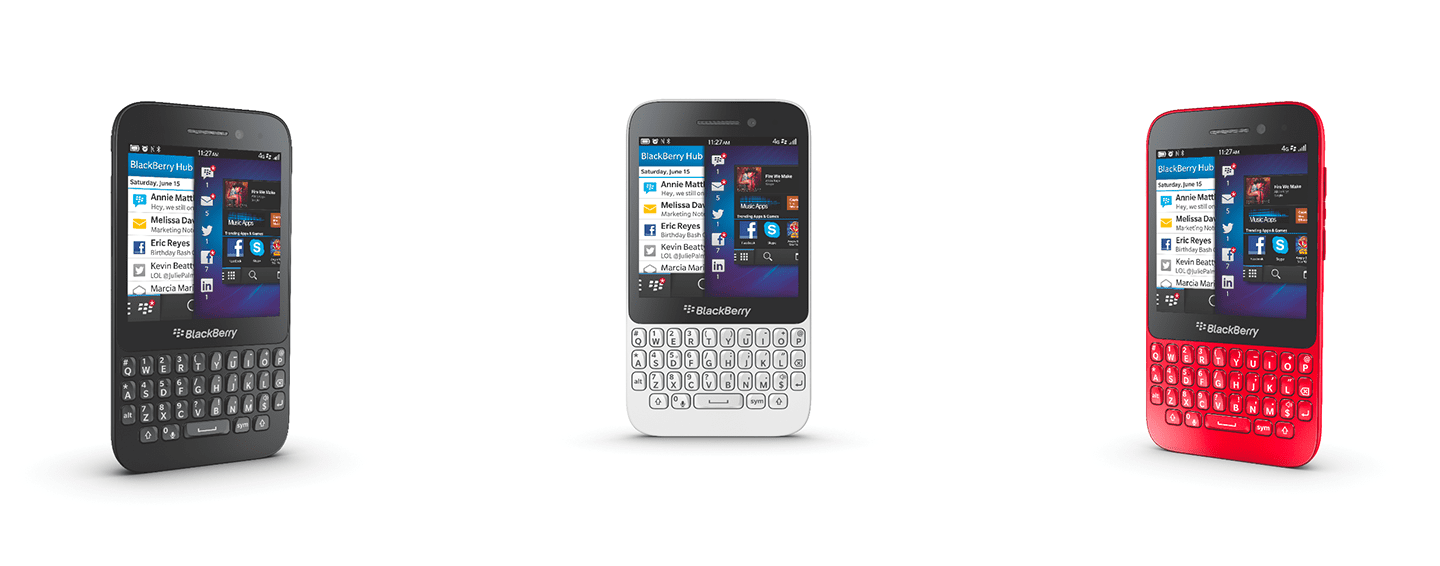

The 2.7 million BlackBerry 10 devices shipped in the quarter only represented 40 percent of total device sales, which means its older BlackBerry 7 devices still outsold its newer, more profitable product line. The company also didn’t break out how well the BlackBerry Z10 did relative to theQ10, which just went on sale in many markets this month.

The numbers, which represent the first full quarter of sales of its BlackBerry 10 devices, have some wondering whether the company can keep up the momentum and excitement it managed to generate after the launch. The stock has been choppy in recent months, but remain markedly above the January levels as investors took a wait-and-see approach and erred on the optimistic side.